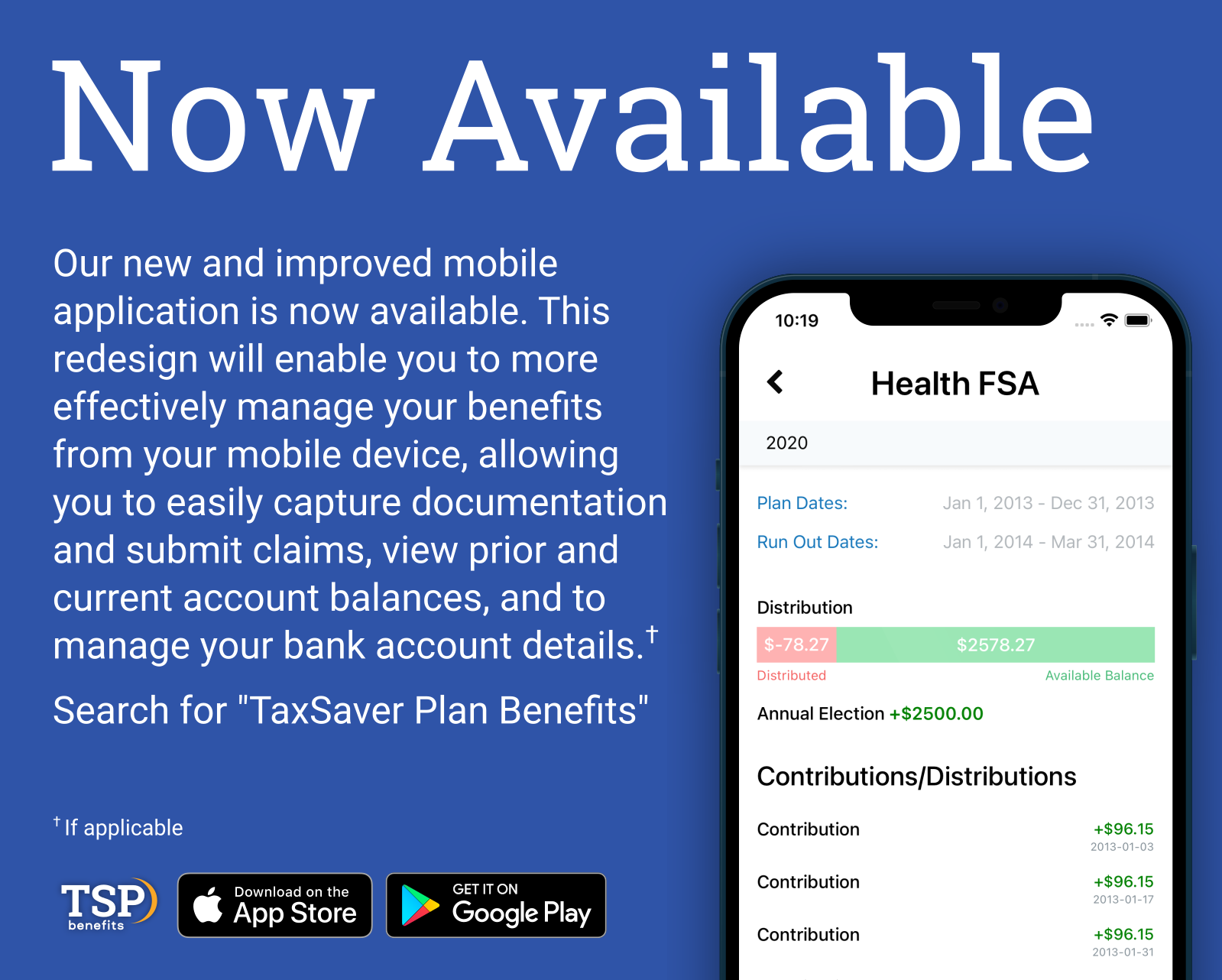

tax saver plan app

Self-Employment Calculator Tax Bracket Calculator W4 Calculator Tax Checklists Mobile App Tax Extensions TaxAct Blog Support Business Taxes Professional Taxes 0. Estimate your tax refund using TaxActs free tax calculator.

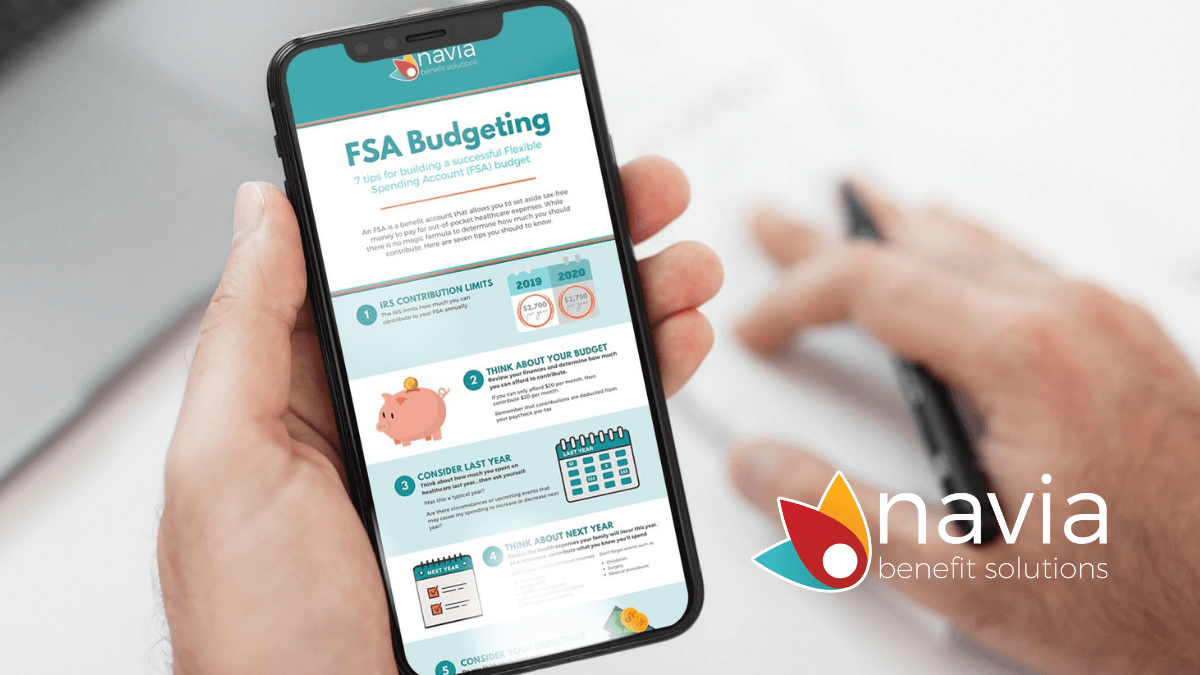

Navia Benefits Tax Savings Calculator

A monthly SIP of 5000 started in the Mirae Asset Tax Saver fund since it was introduced seven years ago would have now be worth about 722 lakh.

. To manage all your insurance needs. Get tax deduction up to 150000 under Section 80C. Download Black by ClearTax App to file returns from your mobile phone.

Scheme Inception date is 23112005 for Regular Plan 01012013 for Direct Plan. DSP Tax Saver Fund. Track your portfolio 24X7.

Metras new Super Saver Monthly Pass available for July August and September is good on any line at any time across any number of zones. Quant Tax Plan Direct-Growth. Invest as small as 10000.

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. Save tax by paying rent to your parents Salaried individuals can save tax by paying rent to their parents and availing the House Rent Allowance HRA exemption benefit. The performance details provided herein are of regular plan.

Different plans have. The fund has 9291 investment in domestic equities of which 6375 is in Large Cap stocks 1086 is in Mid Cap stocks 574 in Small Cap stocksThe fund has 019 investment in. Save taxes with Clear by investing in tax saving mutual funds ELSS online.

New Tax Regime The basic exemption limit is Rs 25 lakhs for an individual a senior citizen and a super senior citizen. Old Tax Regime The basic exemption limit is Rs 25 lakhs for an individual Rs 3 lakh for a senior citizen and Rs 5 lakhs for a super senior citizen. Income Tax Deductions under Section 80.

Dual benefits of attractive interest rates and tax saving. Section 80U Deduction in Income Tax. And its just 100.

Income Tax Section 80 HRA. Reviving the Tata Neu super-app is a super-sized challenge for the. DSP Tax Saver Direct Plan-Growth.

To manage all your insurance needs. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download the Policybazaar app.

You cant be the propertys co-owner. Most tax-saving investment plans fall under Section 80C of the Income Tax Act which makes the taxpayer eligible for exemption of up to a maximum limit of Rs 150000. Section 80C Deduction for FY 2019-20.

Risk Ratios Ratios are calculated using the calendar month returns for the last 3 years. What is Reliance Tax Saver Plan. And its just 100.

Section 80D Deductions for FY 2019-20. What is Reliance Tax Saver Plan. Minimum investment of 10000 and maximum of 150000 for a duration.

Invest in Direct Mutual Funds New Fund Offer NFO Discover 5000 schemes. Income Tax Section 80 HRA. Income Tax Deductions under Section 80.

Check Quant Tax Plan Direct-Growth Review on The Economic Times. Section 80C Deduction for FY 2019-20. Get Portfolio of Kotak Tax Saver Fund Get NAV of all Plans of Kotak Tax Saver Fund Get Update performance of Kotak Tax Saver Fund Invest in Kotak Tax Saver Fund.

Harsha Upadhyaya has been managing the fund since 25082015. Charanjit has a total work experience of over 16 years. MC30 is a curated basket of 30 investment-worthy.

Invest In MC 30. Factors like safety of the fund liquidity and size of returns are the things to consider while zeroing on the right tax-saving investment plan. Download the Policybazaar app.

Thanks to the Fair Transit South Cook Pilot Metra Electric and Rock Island line riders pay a. However the property in which you are staying in needs to be owned by one or both your parents. See how income withholdings deductions and credits impact your tax refund or balance due.

Meanwhile the investment if initiated. Flexible interest pay out monthly quarterly or reinvestment in principal. Section 80D Deductions for FY 2019-20.

Section 80U Deduction in Income Tax. Know before you invest.

Smart Saver Account Achieve Long Term Savings Goals Bmo

Mirae Asset Tax Saver Fund Vs Axis Long Term Vs Quant Tax Plan Vs Canara Robaco Tax Saver Fund Youtube

Participant Portal Access Taxsaver Plan

Icici Prudential Long Term Equity Fund Tax Saving Direct Plan Growth Latest Nav Returns Performance 2022

How To Stop A Systematic Investment Plan Sip In The Paytm Money App Quora

What Is Lock In Period Its Importance In Investment

Elss Funds Meaning Types Advantages How To Invest

17 Best Income Tax Saving Schemes Plans In 2022

Tax Calculator Designs Themes Templates And Downloadable Graphic Elements On Dribbble

App Design By Illustrator Investing App Design Mutuals Funds

Elss Investment From Zerodha Coin Tax Saving Mutual Funds Explained In Hindi Youtube

Best Elss Mutual Funds To Invest In India 2022

17 Best Income Tax Saving Schemes Plans In 2022

17 Best Income Tax Saving Schemes Plans In 2022

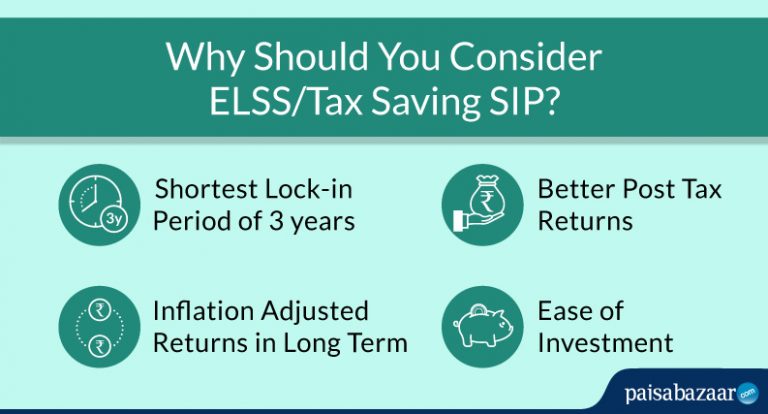

Best Tax Saving Sips 5 Top Sip Mutual Funds For 2020 Paisabazaar Com

Reliance Tax Saver Elss Fund Features Benefits Reviews

Tax Calculator Designs Themes Templates And Downloadable Graphic Elements On Dribbble

Tax Saving Investments Best Tax Saving Investments Under Section 80c